Chinese investors skeptical as Gulf pushes for deeper economic ties with Beijing

Gulf states are building economic ties with Beijing in non-energy fields, but Chinese investors remain skeptical of ambitious economic diversification plans in the Gulf.

This is an excerpt from the Gulf Briefing, Al-Monitor's weekly newsletter covering the big stories of the week across the Gulf. To get it directly to your inbox, sign up here.

DUBAI — China’s largest sovereign fund, China Investment Corporation (CIC), and Bahrain-based asset manager Investcorp announced on Wednesday the launch of a Sino-Gulf investment platform. Bin Qi, the executive vice president of CIC, said the platform aims to deploy $1 billion of Chinese and Gulf capital into high-growth companies in Saudi Arabia, other Gulf countries and China to “strengthen financial and industrial ties between China and GCC countries.”

The commitment by CIC to deepen Sino-Gulf ties comes as Gulf countries signal an intent to expand economic ties with the world’s second-largest economy beyond energy trade. Beyond the industrial knowledge and vast resources that Chinese investors can bring into expanding Gulf non-oil economies, inflows of Chinese capital help Gulf countries diversify their economic partnerships and source of foreign direct investments in a world increasingly seen as multipolar. Saudi Arabia — which hopes to jump-start an array of new sectors such as tourism, entertainment and sports, and to expand existing industries — is in talks with Chinese stock exchanges to allow cross-listings and make it easier to tap into Chinese capital.

Earlier this month, Saudi Arabia embarked on a roadshow in Beijing, Shanghai and Hong Kong to court Chinese investors, as it struggles to lure the foreign investment it needs to get several projects off the ground at Neom. That includes The Line, a megastructure described during the China tour by Neom’s executive director Tarek Qaddumi as the “anchor” of Neom.

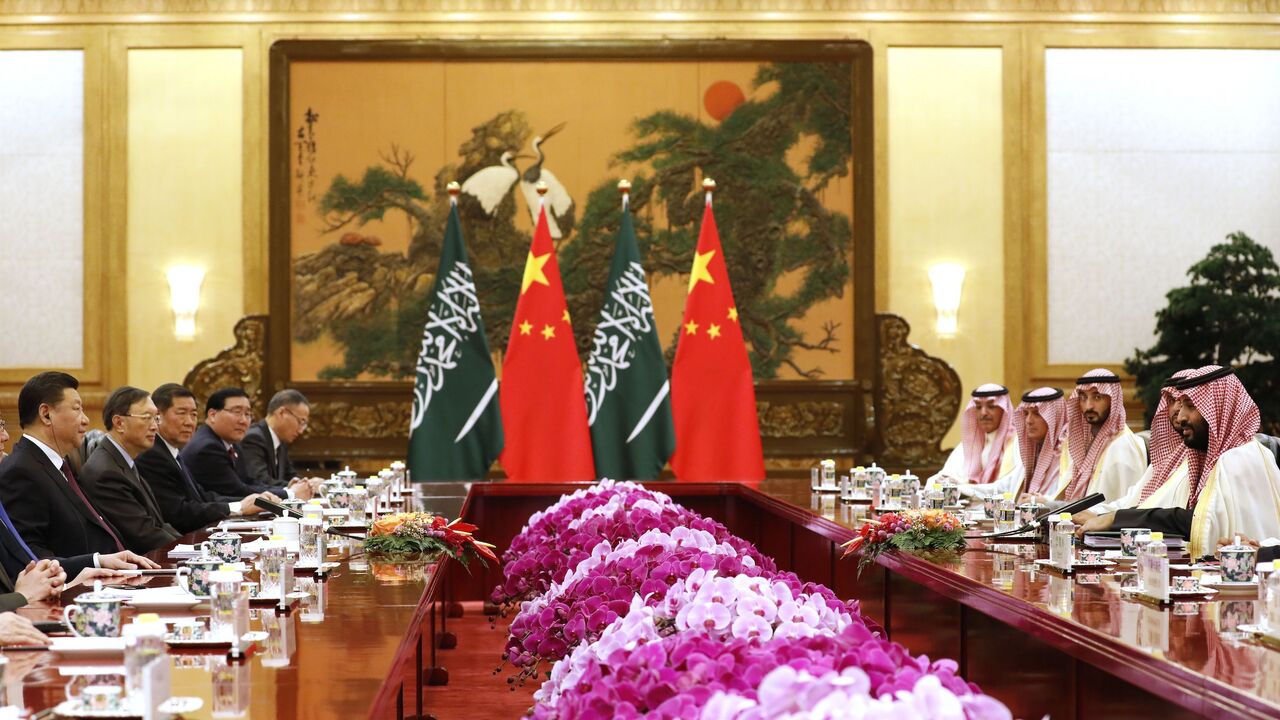

The Chinese leg of Neom’s global tour aimed at making the brainchild of Crown Prince Mohammed bin Salman “less mysterious” to over the 500 senior business leaders in attendance. Hong Kong’s secretary for commerce and economic development, Algernon Yau, said the Chinese special administrative region “stands ready” to support Saudi Arabia in achieving its plans, but no major deals were announced, and reactions were reportedly “mostly neutral.”

Gulf countries capture only a tiny portion of China’s global investment. China’s Ministry of Commerce estimated China's worldwide outward direct investment at $148 billion in 2023. According to the China Global Investment Tracker of the American Enterprise Institute, Gulf Cooperation Council countries received a total of $9.5 billion Chinese investments worth at least $100 million in the years from 2020 to 2023, more than 70% of which targeted Saudi Arabia’s energy sector. Still, China is the third-largest foreign investor in the UAE, with investments worth $9.3 billion as of 2021.

Subscribe for unlimited access

All news, events, memos, reports, and analysis, and access all 10 of our newsletters. Learn more

Continue reading this article for free

Access 1 free article per month when you sign up. Learn more.

By signing up, you agree to Al-Monitor’s Terms and Conditions and Privacy Policy. Already have an account? Log in

.jpg?h=502e75fa&itok=bfs8C-67)