Saudi Arabia opens up to new fintech players

While Saudi Arabia’s fintech sector presents opportunities for entrepreneurs, VC investors and consumers, there are specific, long-standing challenges hindering the market’s full potential.

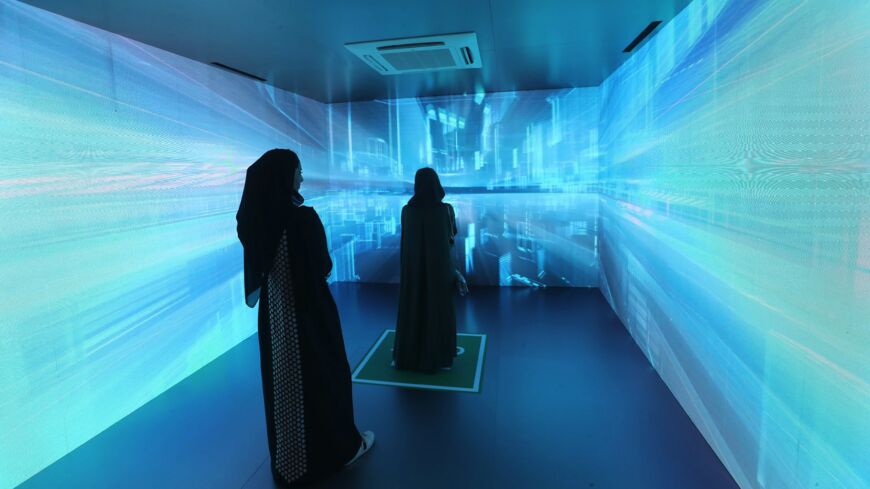

Financial technology (fintech) is set to play a key role in Saudi Arabia’s economic and financial development. Over the past couple of years, the kingdom has taken a series of steps to introduce policies and initiatives to develop an ecosystem that not only boosts the domestic financial sector but also competes against other fintech ecosystems.

On Sept. 29, the Saudi Central Bank (SAMA) announced that it permitted a number of companies to offer Open Banking Solutions — a digital method enabling customers to securely share financial data with third parties — in its Regulatory Sandbox, a platform open to fintechs and financial firms to test new digital solutions before launching on the market. These companies include Wally Global Arabia, Sanam Aliliddikhar for Information Technology, Istishraf Al-Bayanat for Financial Technology and Spare Arabian Financial Company.

Subscribe for unlimited access

All news, events, memos, reports, and analysis, and access all 10 of our newsletters. Learn more

Continue reading this article for free

Access 1 free article per month when you sign up. Learn more.

By signing up, you agree to Al-Monitor’s Terms and Conditions and Privacy Policy. Already have an account? Log in